আরও দেখুন

28.02.2025 02:12 PM

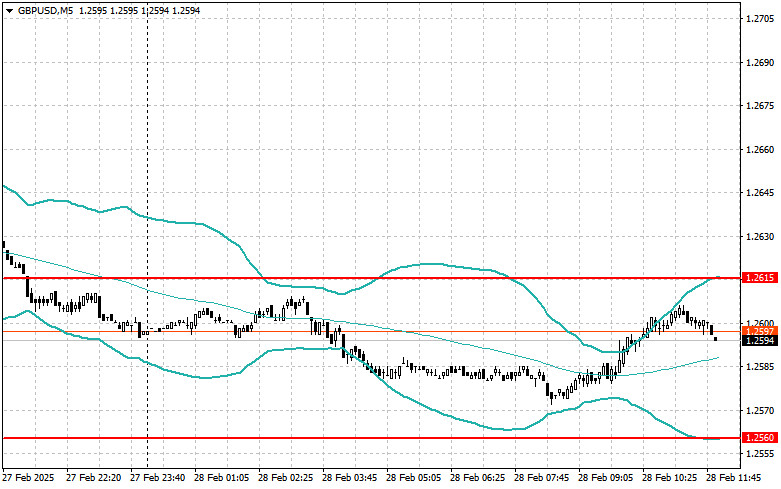

28.02.2025 02:12 PMDue to cautious market sentiment following yesterday's comments from Donald Trump and a major sell-off in risk assets, there was little notable activity in terms of trades during the first half of the day. The British pound nearly provided an entry point under the Mean Reversion strategy, but a reversal did not materialize.

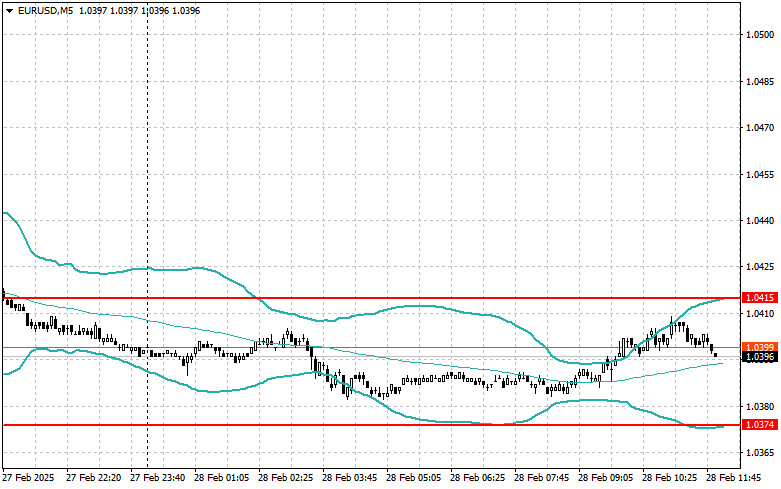

Disappointing economic data from Germany and France weighed on the euro earlier in the day. This negative trend highlights persistent weakness in consumer demand in the eurozone's largest economy, adding pressure on the single currency. Traders also fear that declining consumer activity could further delay the region's economic recovery, which, as reflected in yesterday's reports, is already struggling. Additionally, expectations of future ECB rate cuts continue to dampen enthusiasm among euro buyers.

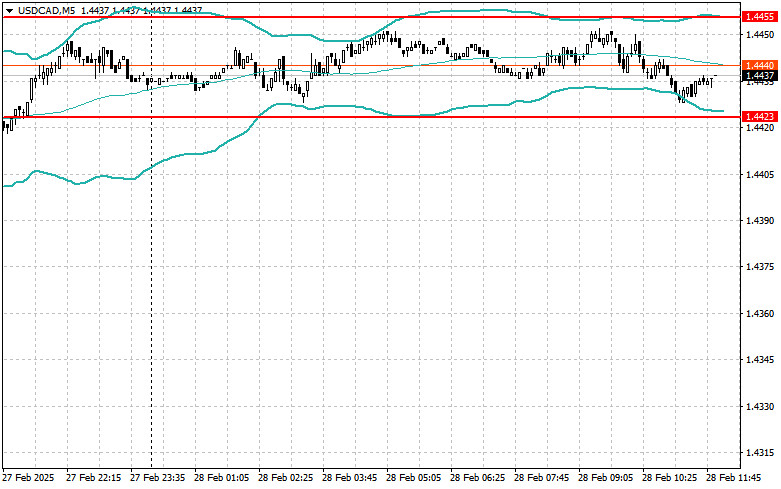

This afternoon, the focus will shift to the Core Personal Consumption Expenditures (PCE) Index, a key indicator for U.S. inflation trends. A higher-than-expected reading could trigger a strong rally in the U.S. dollar, as it would suggest that the Federal Reserve may delay interest rate cuts. Alongside this, data on consumer spending, personal income, trade balance, and the Chicago PMI index will serve as the final macroeconomic events of the week. Weak figures could erode the dollar's strength.

If the economic data is strong, I will focus on implementing the Momentum strategy. If the market fails to react decisively, I will continue using the Mean Reversion strategy.

Mean Reversion Strategy (Reversal Trading) for the Second Half of the Day:

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।